Isleworth Not Taking Nat West Closure Lying Down

Outraged residents want bank branch to be reopened

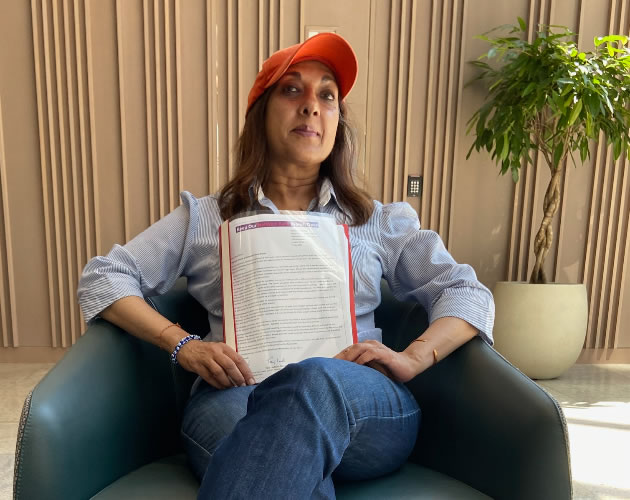

A group of the bank's former customers with Cllr Louki and Ruth Cadbury MP. Picture: Tony Louki

July 17, 2023

Isleworth residents are fighting to reinstate a local bank after its closure earlier last week. Isleworth locals say that NatWest’s decision to close its last outlet in the area risks creating a ‘banking desert’ that will disproportionately affect elderly and disabled people.

Hounslow councillor Tony Louki, as well as MP Ruth Cadbury, have backed outraged locals who have been arguing against the branch shutting its doors for the past few weeks. NatWest has cited dwindling footfall in the brick-and-mortar location as the reason for its closure however regular users of the bank have called this “nonsense” saying there are “queues of people” looking to deposit cash or have face-to-face meetings.

Madhuri Kapila, an Isleworth resident and worker at the nearby West Middlesex University Hospital, has been campaigning to stop the bank’s permanent closure. In recent weeks she has started a petition, spoken to residents and local businesses, and even stood outside the front of the bank and counted the number of people that come in and out.

She says the figures the bank is using to justify the branch’s closure are misleading, relying on data from during the pandemic. “What they have put on their leaflet [about the branch’s closure] is wrong about the footfall count because I have stood there every day for two hours and counted 30 people going in every half an hour.”

“We’ve had people coming in asking ‘where are we going to go?’ They are told Hounslow High Street, but what about the carbon footprint? [We’ve had] disabled people asking ‘where are were going to park?’ That’s been the response.”

She added, “They shut the Barclays, so the NatWest was the only bank in Isleworth and it served a lot of people. Hounslow High Street only has two or three counters. That means there are going to be lines. Sometimes you can’t do it online; these are businesses, they [need] to put cash in.”

Madhuri At Natwest HQ with Petition. Picture: Cllr Tony Louki

Suggestions of the Post Office as an alternative to pay in and withdraw cash is not an effective solution, she argued, as “that also only has two people serving”.

Madhuri and Cllr Louki both agree that the shutdown will be a massive inconvenience for everyone in the area. Trips to Hounslow High Street will take people up to an extra hour round trip via public transport, especially for elderly or disabled residents, while driving could only take 15 minutes more to get there however the branch doesn’t have dedicated parking.

Residents face similar issues if they decide to visit a new banking hub recently opened in Acton, with long journeys, particularly for older or more immobile people acting as a hindrance. Cllr Louki says some of the more vulnerable people will simply not go to a physical bank after the closure because of the difficult journey, with online and phone banking serving as an unsatisfactory alternative.

Queues at Nat West before the closure. Picture: Cllr Tony Louki

Beyond the impracticalities of the bank closure, Madhuri says it means the destruction of a long-standing and beloved community hub. “It’s such a sad situation. I went to the bank [the day it shut, July 12] and I had people there crying who have been going there for 50-60 years. I have just seen a lot of tears there, people in wheelchairs, carers, because now they will have to travel to different areas.

“Some people like to just potter along and say ‘hi’. I heard a customer say that his wife had a heart attack and he mentioned it to the branch and the next day he got flowers [from staff] and he said ‘in this day and age who does that?’”

Cllr Louki adds, “There were good staff there, very good staff, they are friendly and they get to know people. They would give flowers to customers’ families who had died. It was a community bank.”

The closure will affect local businesses as well. Marlena Switkowska is the owner of the flower shop, The Camomile Flower Design, which is across the road from the now-defunct bank. After establishing her business, she says the convenient location of the bank meant she swapped her accounts to NatWest.

“For me as a business [the closure] is not good. I was using this bank for my business. A lot of their customers are my customers, so it will have a huge impact on my business.

“I’m seeing old people queuing for the bank every single day and I’m thinking ‘where are those people going to go?’ because Hounslow [town centre] obviously isn’t the best. I go there to pay in all my cash and cheques using that bank.

“Obviously I can’t pay in cash online so will I have to find a different branch but because we are a small business and I’m working here myself Monday to Saturday it will be almost impossible for me to pay in cash because banks close around 4-5 o’clock and I work until 5.”

Marlena says the bank closure will affect her footfall as many people who otherwise wouldn’t come to the area used the bank and then visited her shop. She says that she believes elderly people are going to be heavily affected.

Bank closures have become a trend in recent years, with the impact of Covid and the proliferation of online banking seeing branches close across the country. Cllr Louki says that this trend has hit Isleworth residents particularly hard.

“It’s an accessibility and equalities issue,” he says. “They [NatWest] say 65 per cent of customers use online facilities but that means that 35 per cent don’t, either they don’t have the means or aren’t online savvy. Older people and their carers [will be mostly affected] but bear in mind we have the fire station down the road, we’ve got the ambulance station down the road, we’ve got the hospital, we have local traders. All will be affected.”

Cllr Louki says residents in his ward have seen all their local banks close in the past few years. “We use to have a Barclays on London Road that’s now a Sainburys, we use to have another Barclays up on Thornbury Road that’s now a dentist, we used to have Barclays down on South Street, Isleworth that’s now a travel agents, we had the NatWest bank on Gillette Corner, that was the only bank on the Great West Road left, that and the old HSBC bank, they’re gone. Another one up at Lampton, it’s gone.”

The councillor says that over his nine years in the role he has found that around 25 per cent of residents he corresponds with don’t have email, meaning for many online banking is practically impossible. With the bank’s closure last week, Cllr Louki says that while the fight is to get the bank reopened, he admits he has never heard of a bank reopening once it has shut its doors.

In light of the NatWest profit report for the first quarter of the year, Cllr Louki has questioned the decision to close the branch on the basis of financial and footfall reasons. Figures show a 50 per cent jump in profits (£1.9 billion) in the first three months of the year making the branch’s closure an even more bitter pill to swallow.

NatWest has been contacted for comment.

Rory Bennett - Local Democracy Reporter

Like Reading Articles Like This? Help Us Produce More This site remains committed to providing local community news and public interest journalism. Articles such as the one above are integral to what we do. We aim to feature as much as possible on local societies, charities based in the area, fundraising efforts by residents, community-based initiatives and even helping people find missing pets. We’ve always done that and won’t be changing, in fact we’d like to do more. However, the readership that these stories generates is often below that needed to cover the cost of producing them. Our financial resources are limited and the local media environment is intensely competitive so there is a constraint on what we can do. We are therefore asking our readers to consider offering financial support to these efforts. Any money given will help support community and public interest news and the expansion of our coverage in this area. A suggested monthly payment is £8 but we would be grateful for any amount for instance if you think this site offers the equivalent value of a subscription to a daily printed newspaper you may wish to consider £20 per month. If neither of these amounts is suitable for you then contact info@neighbournet.com and we can set up an alternative. All payments are made through a secure web site. One-off donations are also appreciated. Choose The Amount You Wish To Contribute. If you do support us in this way we’d be interested to hear what kind of articles you would like to see more of on the site – send your suggestions to the editor. For businesses we offer the chance to be a corporate sponsor of community content on the site. For £30 plus VAT per month you will be the designated sponsor of at least one article a month with your logo appearing if supplied. If there is a specific community group or initiative you’d like to support we can make sure your sponsorship is featured on related content for a one off payment of £50 plus VAT. All payments are made through a secure web site. |